Computation of Income (COI) of ITR

Looking for help with Income Computation in Rajkot, Morbi, or Jamnagar? Our skilled team is ready to guide you from start to finish. We’ll explain the rules, help gather the documents you need, and take care of the entire computation of income. We pride ourselves on accuracy and efficiency, guaranteeing your income computation results in just 5 to 7 business days, regardless of your location. Get in touch with us now to begin your Income Computation journey in Rajkot, Morbi, or Jamnagar.

Get Your Income Computed in Rajkot in Just 5 Days

CA Certified Computation of Income of ITR

To calculate income, begin by summing up all sources of revenue such as wages, business earnings, rental income, and interest. Deduct any allowable expenses directly associated with earning that income, as well as standard deductions and exemptions specified by tax regulations, such as those for healthcare or retirement contributions. This results in the taxable income. Apply the appropriate tax rates to this amount to determine the total tax payable. Additionally, ensure you consider any tax reliefs, rebates, or credits you qualify for, as these can reduce your tax liability.

Accurate income calculation is essential for financial planning, tax compliance, and supporting applications for loans, insurance, or immigration. It aids individuals and businesses in creating effective budgets, assessing creditworthiness, and making informed investment decisions. Ensuring all income and deductions are reported correctly in the Income Tax Return and filing it within the stipulated time frame is crucial to avoid penalties and ensure financial precision. Mastering this process allows for better financial management and planning for a secure future.

Professional Online Income Computation - Rs. 750 Annually

Accurate and efficient income computation is essential for managing finances and staying compliant. Our online income computation service, available for Rs. 750 annually, offers the following benefits:

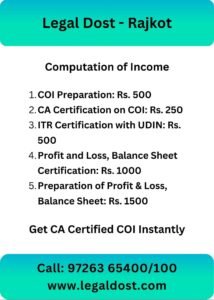

- COI Preparation: Rs. 500 Annually

- CA Certification for COI: Rs. 250 Annually

- ITR Certification with UDIN: Rs. 500Annually

- Profit and Loss, Balance Sheet Certification: Rs. 1000

- Profit and Loss, Balance Sheet Preparation: Rs. 1500

Instant CA-Certified COI in just 30 Minutes

Kindly send the COI-related documents via WhatsApp or email to facilitate COI generation.

Then, we will send a draft COI for your review. Upon approval, our CA will finalize it with the UDIN.

Now, you will obtain the CA-certified COI within 30 minutes. We provide nationwide courier delivery services.

What are the Key Reasons for Income Computation in Rajkot?

Income computation is important for managing finances for individuals and businesses in Rajkot. Here are the main reasons why accurate income computation matters:

- Understanding Finances: Know how much you earn from different sources to plan spending and saving.

- Tax Planning: Calculate taxes accurately and make use of deductions and credits.

- Getting Loans: Provide income details to speed up loan approvals.

- Insurance Choices: Choose the right insurance coverage based on your income.

- Smart Investments: Make wise investments by considering your income, taxes, and expenses.

- Legal Compliance: Follow tax laws correctly to avoid penalties.

- Money Management: Track income growth and spending easily.

- Business Planning: Help businesses plan finances accurately.

- Visa Applications: Show financial stability for visa or immigration.

- Audit Ready: Keep organized records to handle audit questions smoothly.

Expert Income Calculation Services in Rajkot, Morbi, Jamnagar and Nearby Areas

We provide income calculation services for businesses in Rajkot, Morbi, Jamnagar, Surendra Nagar, Botad, Amreli, and Junagadh. Our services include calculating income, preparing financial documents, tax assessments, creating reports, and ensuring tax compliance. We handle all the paperwork to keep you penalty-free. Our experts support you so you can concentrate on your business. Contact us for accurate and easy income calculations.

Choosing a Financial Expert for Income Calculations in Rajkot

Selecting a financial expert for income calculations in Rajkot involves careful consideration of various factors to ensure accurate and reliable financial advice. It is crucial to look for a professional with a strong background in finance, such as a certified public accountant (CPA) or a chartered accountant (CA), who possesses comprehensive knowledge of local regulations and tax laws. Additionally, the expert should have a proven track record of working with clients in similar financial situations and a reputation for integrity and precision. Evaluating client testimonials, seeking referrals, and conducting interviews can help in identifying a competent financial expert who can provide tailored income calculation services, ensuring compliance and optimal financial planning.

Computation of Income Consultant Near Me

Office Name: Legal Dost

Mobile No.:+91 9726365100

Email: office@legaldost.com

Services: COL Preparation and ITR Certificate with UDIN

Office Address: 4th Floor, Jasal Complex, 448, 150 Feet Ring Rd, near Nanavati Circle, opp. Sterling Hospital, Satyanarayan Park, Gandhigram, Rajkot, Gujarat 360007

Complete FAQ Guide: Computation of Income in Rajkot

Financial experts, accountants, and tax consultants in Rajkot can assist you with income computation. They have the expertise to ensure accurate calculations and compliance with local regulations.

Common documents include salary slips, bank statements, investment records, rental income details, business income records, and documents related to deductions and exemptions.

Income should be computed at least annually for tax purposes. However, regular monthly or quarterly computations can help in better financial planning and management in Rajkot.

By accurately computing your income, you can identify tax-saving opportunities, make informed investment decisions, and ensure you take full advantage of available deductions and exemptions in Rajkot.