GST Returns Filing Consultant in Rajkot

Are you looking for a GST returns filing consultant in Rajkot, Morbi, or Jamnagar? We’ve got you covered! We’re India’s top GST Return Filing Consultant, serving all across the country, including these regions. Our service makes filing your GST returns easy. We help you report your income, expenses, sales, purchases, and tax liability to the authorities using your GSTIN number. It’s important to follow the GST rules, and we’re here to make sure you do. Our experts handle filings like GSTR-3B, GSTR-1, and GSTR-9, ensuring they’re submitted on time. This means you can focus on your business while we take care of the paperwork. Contact us today for more information.

Get a GST Filing Consultant in Rajkot

GST Return Filing Service in Rajkot

As a GST return filing consultant, our main job is to help businesses follow the rules laid out in the Goods and Services Tax (GST) Act of India. This includes ensuring correct registration, timely return filing, and accurate financial reporting. We verify tax credits, stay updated on GST Act changes, and keep information secure, ensuring businesses meet their GST obligations. Beyond compliance, we offer support and guidance, explaining GST laws so businesses understand their responsibilities. Our professional, honest, and clear communication builds trust, making GST compliance easier for businesses of all sizes. Let’s simplify your GST processes together.

Essential Documents for GST Filing in Rajkot

To Register a GST Filing in Rajkot, You need Sales Invoice, Bills, Bank Statement, and Specific Documents, Below is a List of these Requirements and the necessary Documents for Registration in Rajkot

- Sales Invoices or Sales Register

- Purchase Register or Bills

- GSTR-2A (Auto Fetch)

- Bank Statement

- Accounting Data (if Available)

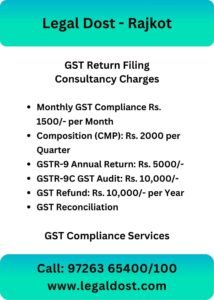

Professional Fees for GST Filing Services in Rajkot

We offer expert GST filing services for businesses in Rajkot. Our experienced team ensures accurate and timely GST compliance, including:

- Monthly GST Compliance: Starting at Rs. 1500/- per month (Includes GSTR-1 and GSTR-3B)

- Composition Scheme (CMP): Rs. 2000/- per quarter

- GSTR-9 Annual Return: Rs. 5000/-

- GSTR-9C GST Audit: Rs. 10,000/-

- GST Refund Processing: Rs. 10,000/- per year

- GST Reconciliation: Fees dependent on transaction volume

Criteria for Selecting a GST Return Filing Consultant

Choosing the right GST return filing consultant is essential for staying compliant and managing your GST effectively. Here are the key things to consider:

- Expertise and Experience: Ensure they have proven experience and deep knowledge of GST laws.

- Reputation and Reviews: Look for positive client reviews and a strong reputation.

- Qualifications and Certifications: Verify their qualifications, such as being a Chartered Accountant.

- Comprehensive Services: They should offer a full range of GST services, including registration, return filing, and audits.

- Technology and Tools: They should use the latest technology for accurate and efficient filing.

- Personalized Support: They should provide personalized, responsive support.

- Transparent Pricing: Ensure their pricing is clear with no hidden charges.

- Compliance Track Record: Check their history of timely and accurate filings.

Choosing a consultant with these criteria ensures your business remains compliant and efficiently manages GST.

Profits and Benefits of GST Return Filing in Rajkot

Filing GST returns in Rajkot offers numerous advantages for businesses, ensuring compliance and promoting growth. Here are the key benefits:

- GST replaces multiple taxes, so you don’t pay taxes on top of taxes, saving money.

- Small businesses with low turnover are exempt from GST, reducing their paperwork and letting them focus on growing.

- GST simplifies tax rules for startups and online businesses, making it easier to understand and comply with.

- GST introduces online filing, reducing paperwork and making it simpler to file taxes.

- GST makes tax rules the same across India, making it easier for businesses to operate in different states

- Businesses can claim back taxes they paid on purchases, reducing their overall tax bill and improving cash flow

- GST aims to grow the economy by making taxes simpler and encouraging more business activity.

- GST uses technology to make it easier to comply with tax rules and catch people who try to cheat on their taxes.

By understanding and leveraging these benefits, businesses in Rajkot can achieve greater financial stability and growth through efficient GST return filing practices.

Procedure for Submitting GST Returns in Rajkot

Our GST expert will analyze your business activities and provide a comprehensive checklist of necessary documents for monthly submission.

At the end of each month, kindly submit the required documents and information promptly, as outlined in our provided checklist.

Our GST specialist and Chartered Accountant will handle the return preparation and filing, ensuring timely and comprehensive GST compliance for your business.

Expert GST Filing Services in Rajkot, Morbi, Jamnagar and Nearby Areas

At Legal Dost, we offer expert GST filing services for businesses in Rajkot, Morbi, Jamnagar, and nearby areas. Our experienced Chartered Accountants and GST specialists ensure comprehensive compliance with GST regulations. We provide assistance with GST registration, preparation, and filing of monthly GSTR-1 and GSTR-3B returns, and annual GSTR-9 returns. Our dedicated team ensures timely and accurate submission of all required documents, allowing you to focus on your core business operations with peace of mind.

GST Filing Service Consultant Near Me

Office Name: Legal Dost

Mobile No.:+91 9726365100

Email: office@legaldost.com

Services: GST Return and Filing

Office Address: 4th Floor, Jasal Complex, 448, 150 Feet Ring Rd, near Nanavati Circle, opp. Sterling Hospital, Satyanarayan Park, Gandhigram, Rajkot, Gujarat 360007

FAQ about GST Returns Filing Consultant in Rajkot

A GST return filing consultant is a professional who assists businesses in filing their Goods and Services Tax (GST) returns accurately and in compliance with GST laws and regulations.

Hiring a GST return filing consultant can help ensure that your GST returns are filed correctly and on time, minimizing the risk of penalties and fines for non-compliance. They can also provide guidance on optimizing your tax liabilities.

GST return filing consultants in Rajkot typically offer services such as GST registration, GST return filing (monthly, quarterly, or annually), GST reconciliation, compliance support, and representation before tax authorities.

You’ll typically need to provide documents such as sales invoices, purchase invoices, bank statements, and other relevant financial records for the period for which GST returns are being filed.